|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

Can You Refinance a Second Home? Exploring Your OptionsRefinancing a second home can be a smart financial move, but it's important to understand the nuances and requirements involved. This guide will help you navigate the process and determine if it's the right step for you. Understanding Second Home RefinancingBefore diving into refinancing, it's crucial to know what it entails and how it differs from refinancing a primary residence. What is Second Home Refinancing?Refinancing a second home involves replacing your existing mortgage with a new one, ideally with better terms or lower interest rates. This can help you save money in the long run. Key Considerations

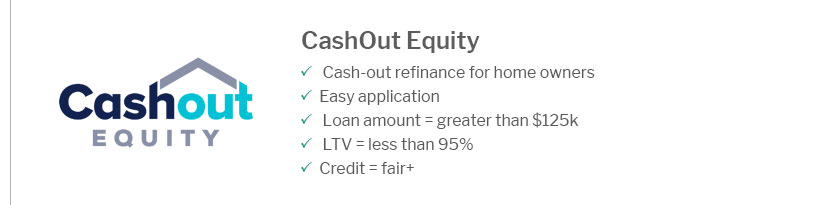

Benefits of Refinancing Your Second HomeRefinancing can offer several advantages, making it an attractive option for many homeowners. Lower Interest RatesSecuring a lower interest rate can significantly reduce your monthly payments and the overall cost of your loan. Cash-Out RefinancingThis option allows you to access home equity, providing funds for renovations or other financial needs. For those considering refinancing other properties, you might also explore how to refinance a manufactured home to see if similar benefits apply. Challenges of Refinancing a Second HomeWhile there are benefits, there are also challenges to be aware of when refinancing a second home. Stricter RequirementsLenders may impose stricter requirements due to the perceived risk of second home loans. Potential for Higher RatesSecond homes might not qualify for the lowest advertised rates, impacting the potential savings. Is It the Right Time to Refinance?Deciding the right time to refinance can be challenging. Factors such as market conditions and personal financial situations play a significant role. Evaluating whether is it best to refinance now can offer additional insights into timing your decision effectively. FAQs About Refinancing a Second Home

Refinancing a second home can offer substantial benefits, but it's essential to weigh these against potential challenges. With careful consideration and expert advice, you can make an informed decision that aligns with your financial goals. https://ibuyer.com/home-equity-refi/can-you-refinance-a-second-mortgage.html

If you are wondering if you can refinance a second mortgage, the answer is yes! It can be a great way to access extra cash, make home improvements, or pay down ... https://www.mortgagesourcesite.com/blog/101237/refinancing-a-home/how-soon-after-buying-can-i-refinance-the-mortgage-of-my-second-home

Some do not have a time limit but getting a refinance on a second home is likely to have stricter requirements than a primary mortgage, so you may have to wait ... https://www.realtor.com/advice/finance/can-i-refinance-at-the-same-time-i-am-buying-another-home/

There's nothing wrong with refinancing one mortgage at the same time that you are buying an investment property or second home with a mortgage.

|

|---|